While prices can be prepaid to potentially save money, these plans typically cannot be transferred to another funeral home, may be lost if the funeral home goes bankrupt, and, in some cases, cannot be changed.

These plans count towards assets for Medicaid, so they are not recommended for people who think they might go onto Medicaid.

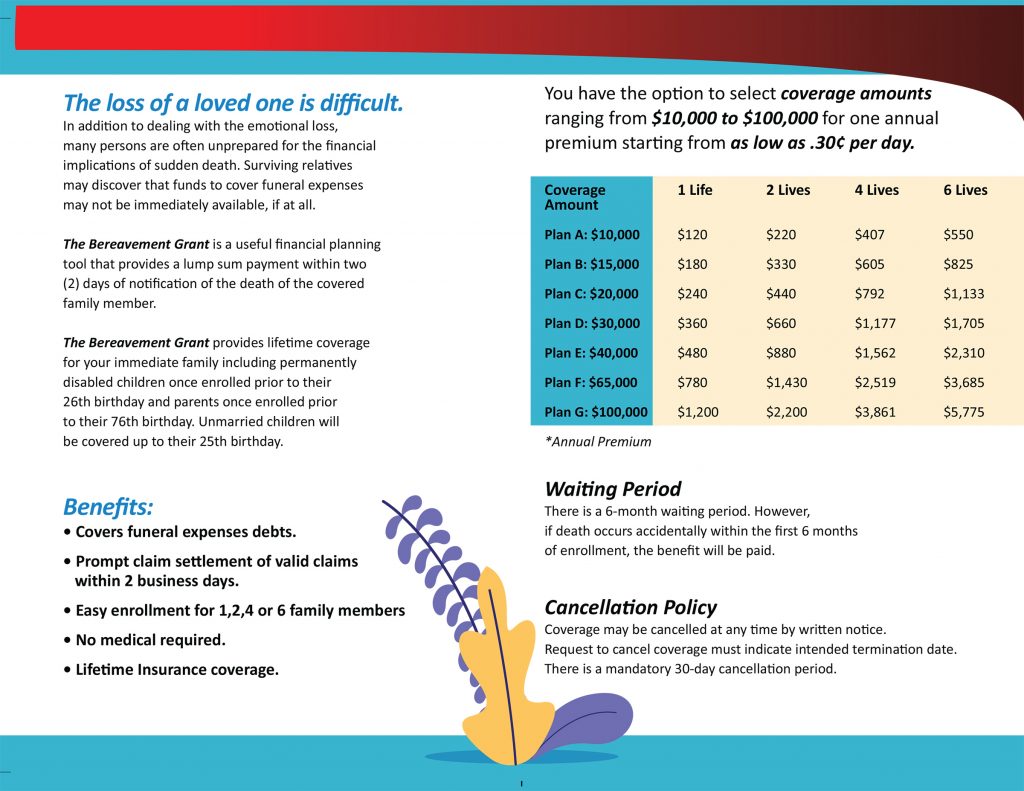

Since these are insurance plans, they will need to go through a claims process, which can take time before receiving the payout. It’s important to understand the fine details in order to grasp the options, costs, and claims payouts. Some have options for guaranteed issue, but that comes with a waiting period and/or graded payouts. Although these plans increase the payout over time, they typically have a better price for someone who can pass underwriting and is younger in age. (Some states allow the funeral home to be the beneficiary.) The funds from these policies can be used for funeral costs as well as other expenses, such as medical bills, credit card debt, and utility expenses. These are typically small whole life insurance policies assigned to a family member, friend, or anyone the policyholder trusts to take care of their end-of-life wishes. Final Expense Insurance or Burial Insurance The benefit of having this product is if an emergency arises, the trustor can access the money, change the amount, or cancel the trust altogether. Unlike an irrevocable Funeral Expense Trust, a revocable Funeral Expense Trust can be changed and is considered a countable asset for Medicaid purposes. It is important to understand state requirements and limits prior to setting one up to avoid violating Medicaid’s look-back period. In most cases, the money is paid out within 24 hours and can be used for approved funeral service costs. An irrevocable Funeral Expense Trust is guaranteed issue but, once set, cannot be changed, reversed, or dissolved for any reason. Since this product is not considered a countable asset by Medicaid, it is mainly used in crisis Medicaid planning or for someone who is sure they will go on Medicaid at some point in their lives. Let’s do a high-level look at some of the different products on the market. These policies will enhance your business by expanding your product portfolio and adding dollars to your bottom line. The Krause Agency has a portfolio of these products that we can help you add to your business. They are either guaranteed issue or have simplified underwriting, and some can be issued up to age 99.

Each product varies slightly and meets different needs for clients in a variety of situations. Not only can these products provide the funds necessary to cover final expenses, but they can also help loved ones more easily navigate such a difficult time.įinal expense products are easy to understand and issued quickly. Fortunately, individuals can choose from a variety of different products designed to plan for end-of-life expenses. While most people want to avoid talking about funerals, it’s important to have these discussions to help families plan ahead. The average funeral costs between $7,000 and 9,000.

0 kommentar(er)

0 kommentar(er)